Understanding the Debt Snowball Method

What Is the Debt Snowball Method?

Imagine Sarah, juggling three credit card debts with balances of $500, $1,500, and $3,000. Overwhelmed by the amounts and monthly payments, she discovered the debt snowball method—a simple yet powerful strategy to regain control. The debt snowball method involves listing all debts from smallest to largest balance and focusing on paying off the smallest debt first while making minimum payments on the others. Once the smallest debt is paid, the freed-up payment amount “rolls over” to the next smallest debt, creating a snowball effect that gains momentum over time. This approach emphasizes quick wins, which can be highly motivating for those struggling to tackle multiple debts.

How It Differs from Other Debt Repayment Strategies

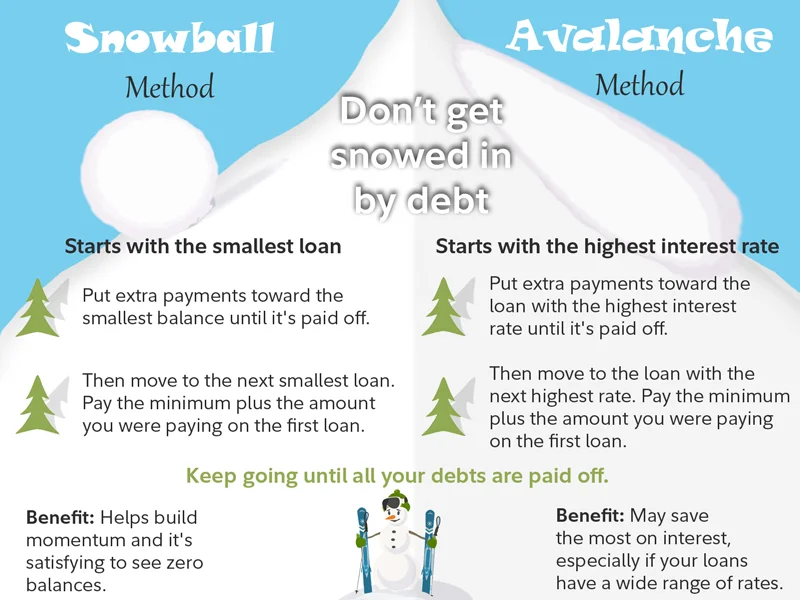

Unlike the debt avalanche method, which prioritizes debts with the highest interest rates to minimize total interest paid, the debt snowball method prioritizes balance size regardless of interest. This means you may pay more interest in the long run, but the emotional boost from paying off smaller debts first often outweighs this drawback for many people. For instance, Mark chose the debt avalanche strategy initially but found himself discouraged by slow progress. After switching to the debt snowball, the satisfaction of paying off smaller balances reignited his commitment. Thus, the debt snowball blends financial discipline with psychological motivation, making debt repayment less daunting and more manageable.

Preparing to Implement the Debt Snowball

Assessing Your Current Debt Situation

Before starting, it’s crucial to take an honest inventory of your debts. Jane sat down one evening with her credit card statements, student loan balances, and auto loan info. By listing each debt’s total amount, minimum monthly payment, and interest rate, she gained clarity on her financial obligations. This honest assessment helps avoid surprises and allows for realistic planning. It’s easy to underestimate the total owed or miss a smaller balance hidden in a rarely used account. Gathering all statements and logging these details creates a foundational snapshot to build an effective repayment plan.

Organizing Debts from Smallest to Largest

Once debts are assessed, ordering them from smallest to largest balance builds the roadmap for the snowball. For example, Tom had five debts: $200 medical bill, $900 store credit card, $1,800 personal loan, $4,500 credit card, and $10,000 car loan. By listing them in this order, he knew to target the $200 medical bill first. This organization provides clarity and a tangible target to focus on. It also transforms an overwhelming debt pile into smaller, manageable goals. Keeping this list visible—on paper or an app—helps maintain focus and track upcoming milestones.

Executing the Debt Snowball Method

Allocating Payments: Minimum vs Extra

After organizing debts, the next step is allocating payments effectively. Rachel made minimum payments on all her credit cards to stay current and avoid penalties. But she focused every spare dollar on her smallest balance. Once that card was paid off, the money she was putting toward it rolled into the next debt. This continuous redirection accelerates payoff and fuels momentum. A practical tip is to automate minimum payments to avoid missed due dates, then manually add extra payments where possible. This approach ensures debts don’t accumulate late fees while speeding up elimination of smaller balances.

Tracking Progress and Staying Motivated

Tracking each payment and celebrating small victories are vital to sustaining motivation. Michael, for instance, kept a spreadsheet updated monthly showing balances shrinking, which gave him a visual sense of accomplishment. He also rewarded himself with small, inexpensive treats for every debt cleared, turning a stressful process into a manageable challenge. Seeing progress not only boosts morale but also reinforces disciplined habits. Many find gamifying debt payoff—such as setting mini-goals or challenges—helps maintain enthusiasm, especially when facing larger or longer-term debts.

Common Mistakes to Avoid

Ignoring Interest Rates

One pitfall is overlooking the impact of interest rates. While the debt snowball method doesn’t prioritize rate differences, ignoring high-interest debts can lead to overall higher costs. For example, Lisa paid off small debts quickly but ignored her credit card with a 24% APR until last. The accumulated interest ballooned her total payment long-term. It’s important to recognize this trade-off and consider combining methods if high interest significantly impacts your budget. Sometimes blending snowball and avalanche strategies can provide both motivation and financial efficiency.

Losing Momentum Midway

Maintaining momentum throughout the repayment journey is challenging. People often lose focus after paying off a few smaller debts and revert to old spending habits. Jake initially made great progress using the snowball method but then splurged on new credit purchases, negating months of effort. Avoiding new debt during this period is critical. Sticking to your payment plan with discipline and keeping emergency funds intact helps prevent setbacks. It’s also helpful to review goals regularly and remind yourself why debt freedom matters, ensuring consistent progress.

Boosting Effectiveness of the Debt Snowball

Using Budget Adjustments

Sarah realized tightening her budget freed up an extra $150 a month she could apply toward debt. She cut discretionary spending on dining out and subscription services. This adjustment accelerated her snowball and shortened the payoff timeline. Even small changes, like brewing coffee at home or carpooling, add up over time. Periodically reviewing and tweaking your budget can uncover additional resources to speed repayment without sacrificing basic needs. This practical step transforms the snowball from a slow crawl into a rapidly growing force.

Leveraging Support Systems and Tools

Support makes a big difference. John joined an online community where members shared successes and challenges related to debt payoff. Hearing others’ stories kept him motivated and accountable. Additionally, using apps designed for debt tracking and automation simplifies the process. Setting up automatic minimum payments prevents late fees, while reminders and progress charts keep momentum visible. Whether through friends, financial advisors, or digital tools, leveraging support structures reduces stress and improves adherence to the debt snowball method.

When to Reconsider Your Debt Repayment Plan

Signs It’s Time to Switch Strategies

If you’ve tried the debt snowball method but find that high-interest debts are growing faster than you can pay, it might be time to reconsider. For example, Emily followed the snowball but noticed credit card interest charges ballooned, delaying overall payoff. Or, if your debts are roughly equal in size yet carry widely varying interest rates, the avalanche method or a hybrid approach could save money. Additionally, if motivation wanes because you don’t see quick progress—such as when no small debts exist—exploring alternative strategies or seeking financial counseling can provide better results. Being flexible and adjusting your plan based on ongoing results is a key part of successful debt management.