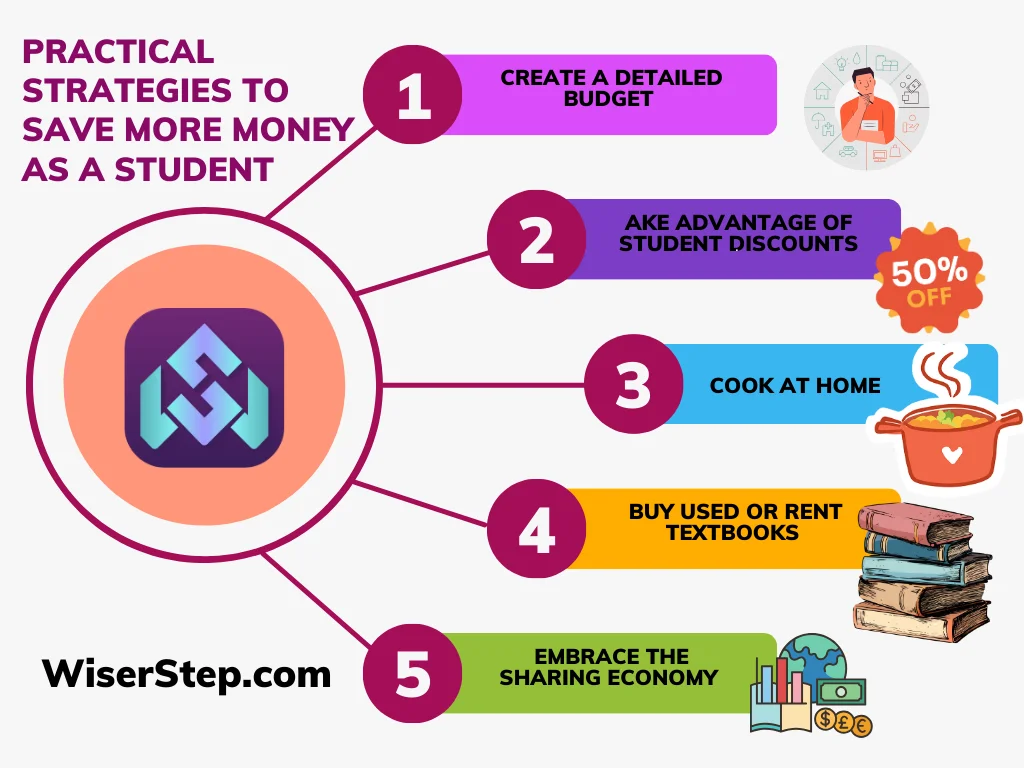

Understanding Your Financial Situation as a Student

Assessing Your Income Sources

Starting college often means juggling multiple income streams, especially when funds are tight. For many students, income might come from part-time jobs, scholarships, financial aid, or family support. Sarah, a sophomore juggling school and work, realized half her monthly income vanished quickly without a clear understanding of exactly where it went. Assessing your income is the first crucial step: list every source and know precisely how much money you have available each month. This clarity helps in creating a realistic budget and avoiding unpleasant surprises that can add financial stress.

Identifying Regular Expenses and Hidden Costs

While tuition and rent might be the obvious monthly expenses, students often underestimate smaller recurring costs that drain their budgets. For instance, textbooks can quickly become a major expense—new editions sometimes cost hundreds of dollars. On top of that, eating out or relying on campus meal plans can quietly erode savings. Consider Alex, who didn’t realize how much he spent on daily coffees and weekend takeouts until he tracked his expenses. Other hidden costs might include transportation fares, laundry fees, or unexpected utility bills in shared housing. Identifying all these expenses creates a full financial picture, enabling better planning and control.

Smart Budgeting Techniques Tailored for Students

The Envelope Method: Limiting Spending by Category

One practical approach to controlling spending is the envelope method, where students allocate cash into labeled envelopes for categories like food, entertainment, and transportation. Jessica switched to this system after noticing her card balance was disappearing mid-month. Handling physical money makes overspending less likely because she physically runs out of cash in a category once the envelope is empty. This method instills discipline and provides instant visual feedback on where the money goes, helping students stay within limits especially when digital tracking alone feels abstract.

Using Budgeting Apps Designed for Student Use

Technology can make managing finances easier for today’s students. Apps like Mint, YNAB, or student-focused tools automatically track spending, categorize purchases, and send alerts for upcoming bills. For example, Raj found an app that synced with his bank account and issued weekly summaries, helping him adjust spending habits before things got out of hand. These apps can also incorporate calendars for due dates, helping students avoid late fees and prioritize bills, which is especially helpful for balancing fluctuating income and diverse expenses.

Prioritizing Needs Over Wants

The challenge in budgeting often lies in resisting impulse purchases or upgrading beyond necessity. Emma tackled this by distinguishing essential expenses—such as rent, groceries, and textbooks—from discretionary spending like concert tickets or new gadgets. She set a clear threshold for wants each month, enjoying small treats but always after covering the basics. Prioritizing needs over wants requires conscious effort but leads to more sustainable financial habits. Adopting this mindset prevents the common pitfall of overspending on non-essentials, ensuring bills are paid on time and credit card debt is avoided.

Maximizing Savings Without Sacrificing Essentials

Strategic Grocery Shopping and Meal Planning

Food is a major budget item for students, and learning to cook can be a game-changer. When Mark started preparing meals in his dorm using a microwave and mini-fridge, he cut his food expenses dramatically compared to frequent dining out. Planning meals around weekly grocery sales and buying staple items in bulk further stretched his dollars. Using apps that scan for coupons or discounts on fresh produce helped him save even more. By cooking at home and minimizing reliance on expensive takeout or campus dining plans, students can eat well while managing tight budgets.

Utilizing Student Discounts and Deals

Many students overlook the convenience of showing their student ID to access exclusive discounts. Online research or simply googling “student discount” can reveal countless deals on everything from software and clothing to transportation and entertainment. Maria, for example, saved on monthly subway passes by buying special student passes, avoiding the daily ticket purchase hassle and cost. Identifying and using these discounts requires some initial effort but yields consistent savings without any sacrifice in quality of life.

Cutting Utility Bills and Shared Housing Tips

Living with roommates or in shared housing offers potential savings on rent, but utility bills can become a source of contention and unexpected costs. Students like Liam started tracking communal energy usage, encouraging everyone to switch off lights and unplug devices when not used. Simple actions—like using energy-efficient bulbs or setting thermostats wisely—added up over the months. Sharing chores to monitor water and electricity consumption kept bills reasonable. These small lifestyle adjustments help keep essential utilities affordable without sacrificing comfort.

Building a Sustainable Financial Habits Early On

Setting Achievable Short-Term and Long-Term Savings Goals

Setting clear savings goals makes budgeting purposeful. Julia began by aiming to save $50 monthly for emergencies while working toward a larger goal of paying for an upcoming trip without loans. Breaking objectives into small, manageable steps kept her motivated and ensured progress. Whether it’s a textbook fund, a holiday budget, or long-term financial stability, defining goals helps prioritize spending and motivates disciplined money management. Realistic goals also prevent the common mistake of becoming overwhelmed and abandoning saving altogether.

Automating Savings: Making It Effortless

Automating transfers to a savings account, even if modest, can build a financial cushion without daily decision-making. Carlos set up his bank account to move $20 weekly into savings right after his paycheck, so he never missed the money. Automation reduces the temptation to spend what is meant for saving and builds consistency. For students managing busy schedules, this hands-off method embeds healthy financial habits early and makes saving a natural part of income management.

Side Hustles and Additional Income Streams for Students

Freelancing Opportunities Compatible with Academic Schedules

Side jobs can ease financial strain but require balance to avoid impacting studies. Freelancing offers flexible options; for instance, Anna leveraged her graphic design skills to work on small projects via online platforms, adjusting hours around classes. These gigs provide income without fixed schedules, helping students earn while gaining valuable experience. Careful time management is vital to ensure academic performance doesn’t suffer while supplementing income.

Leveraging Campus Resources and Networks

Universities are often untapped goldmines for student financial support. Career centers can connect students to on-campus employment, internships, and scholarships. Moreover, student groups and clubs sometimes offer paid roles or access to resource-sharing programs that reduce expenses. Thomas found a peer tutoring opportunity through his academic department that fit his schedule and provided consistent income. Utilizing campus networks not only brings financial benefits but also promotes community involvement and skill development.

Conclusion: Balancing Finances While Students Thrive

Managing finances on a tight student income demands awareness, discipline, and resourcefulness. By understanding income and expenses, applying smart budgeting techniques, maximizing savings, and exploring flexible income options, students can navigate financial challenges while focusing on their education. Practical strategies, like cooking meals instead of dining out or using budgeting apps, make a real difference in day-to-day life. Ultimately, building sustainable habits and leveraging available resources empowers students not only to survive financially but thrive, setting the foundation for a secure future beyond college.