Understanding Balance Transfer Credit Cards

What Are Balance Transfer Credit Cards?

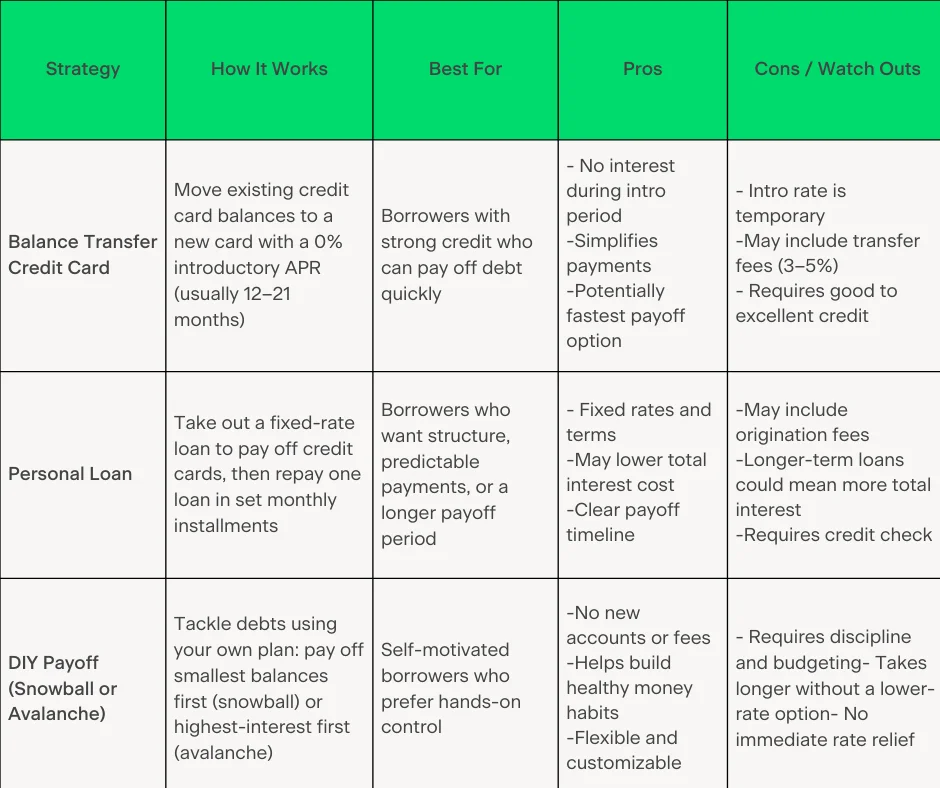

Balance transfer credit cards allow you to move debt from one or more credit cards to a new card with a lower interest rate, often an introductory 0% APR period. This feature aims to reduce the cost of carrying debt and simplify payments by consolidating multiple balances into one account.

How They Help Manage High-Interest Debt

By transferring high-interest balances to a card with a 0% intro APR, you can pause interest accumulation for a set period. This pause helps you focus on paying down the principal faster, ultimately reducing the total interest paid and accelerating debt repayment.

Key Features to Consider When Comparing Cards

Introductory 0% APR Periods

The length of the introductory 0% APR period is crucial. Longer periods provide more time to pay off debt without interest. However, focusing solely on the longest intro period can be misleading if other terms are unfavorable. Notice whether the 0% rate applies to both balance transfers and purchases, as disparities can affect overall savings.

Balance Transfer Fees Explained

Balance transfer fees typically range from 3% to 5% of the transferred amount. Even with a 0% APR period, high fees can offset the benefits of interest savings. Some cards offer promotional periods with lower or no fees, which can enhance the value of the transfer significantly.

Credit Limits and Their Impact on Debt Repayment

Credit limits on balance transfer cards influence how much debt you can move. A higher limit means you can consolidate more balances, but limits can vary based on creditworthiness. Understanding your available credit is key to planning an effective transfer strategy and ensuring you don’t max out the card, which could hurt your credit score.

Top Balance Transfer Credit Cards of the Year

Card 1: Benefits and Drawbacks

The Wells Fargo card offers a 0% introductory APR for 21 months on purchases and qualifying balance transfers, making it one of the longest intro periods available. This can be ideal for those with larger balances seeking extended interest-free time. However, watch for any balance transfer fees and review the card’s rewards structure, as some cards may offer limited rewards.

Card 2: Who Should Consider It?

The Chase Freedom Unlimited card provides a 0% APR for 15 months on both purchases and balance transfers. It combines a reasonable intro period with rewards benefits like cash back on dining and travel. This card suits individuals looking for both debt management and ongoing rewards from everyday spending.

Card 3: Unique Perks and Limitations

The American Express balance transfer card features a 0% intro APR for 15 months on balance transfers but may come with balance transfer fees. It lacks a 0% intro APR on purchases, which could reduce flexibility. While it doesn’t offer extensive rewards, its benefits like no late fees or penalty APRs can help avoid unexpected costs.

Strategies for Using Balance Transfers Effectively

Timing Your Transfers for Maximum Benefit

Initiate balance transfers as soon as possible to maximize the length of the 0% APR period. Delays can shorten the interest-free window, reducing your payoff impact. Also, consider transfer fee promotions and whether the card offers a no-fee introductory period.

Paydown Plans During the 0% APR Period

Create a structured payment plan to pay off as much of the transferred balance as possible before the intro period ends. Without a plan, residual balances may accrue interest at higher rates. Prioritize monthly payments that exceed minimum amounts to accelerate debt reduction effectively.

Potential Risks and How to Avoid Them

Impact on Credit Score

Opening new balance transfer cards or increasing credit utilization may affect your credit score. Keep balances below limits and avoid opening multiple cards simultaneously. Monitoring your credit regularly helps you stay informed and adjust strategies to maintain healthy credit health.

Beware of Deferred Interest and Late Payments

Be mindful that missing payments can trigger penalty APRs, negating the 0% intro benefit and increasing costs. Some cards impose deferred interest if balances are not repaid in time. Make timely payments and understand terms to avoid such pitfalls.

Final Tips for Choosing the Best Balance Transfer Card

Look beyond just the introductory APR length. Evaluate transfer fees, balance limits, rewards, and long-term card benefits. Choose cards without late fees or penalty APRs when possible. Consider additional perks like cash back on purchases or protections such as cell phone coverage to get more value. Finally, maintain good payment habits and monitor your credit to maximize the benefits of your balance transfer strategy.