Understanding Credit Card Balance Transfers

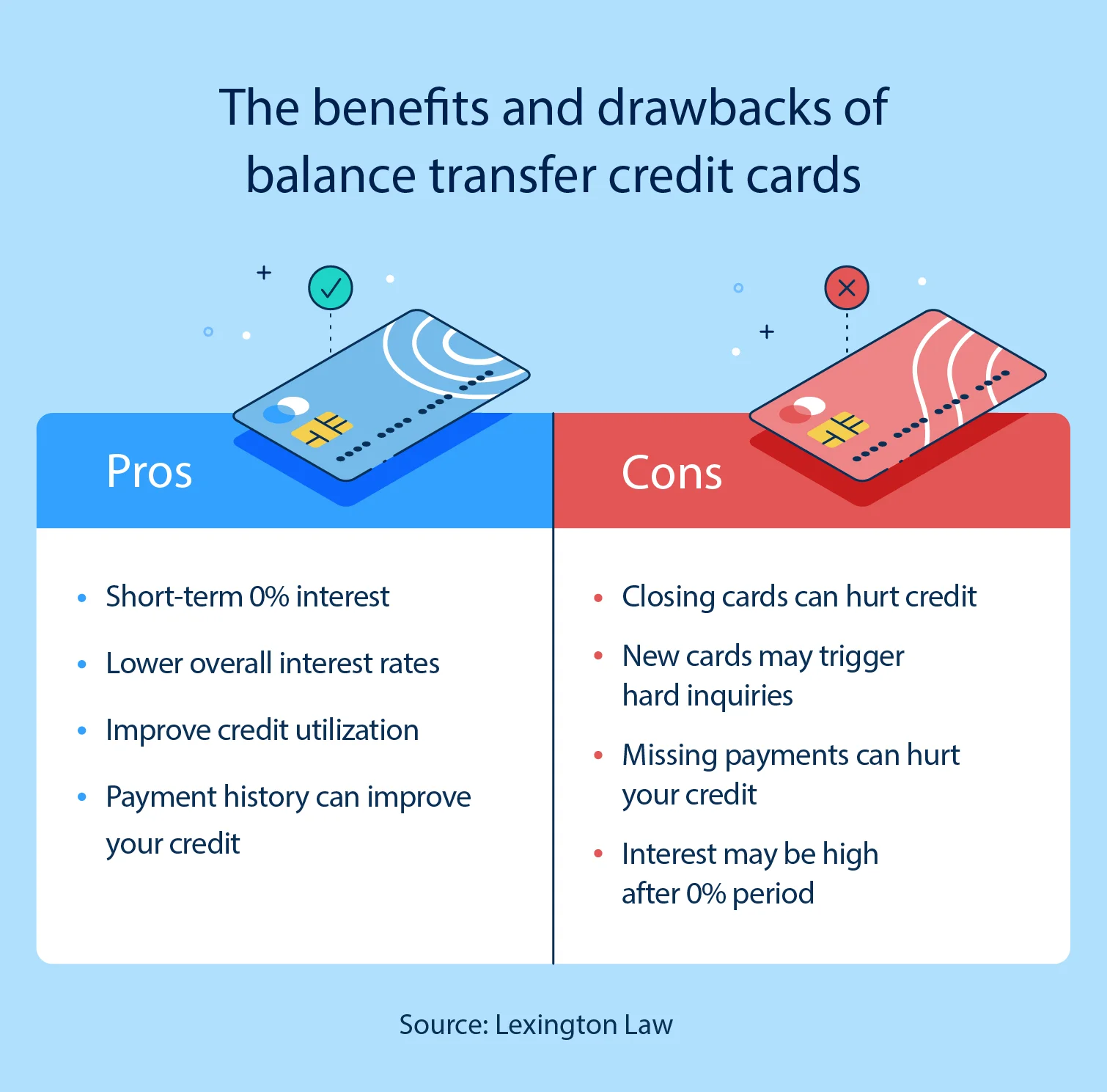

What is a Balance Transfer?

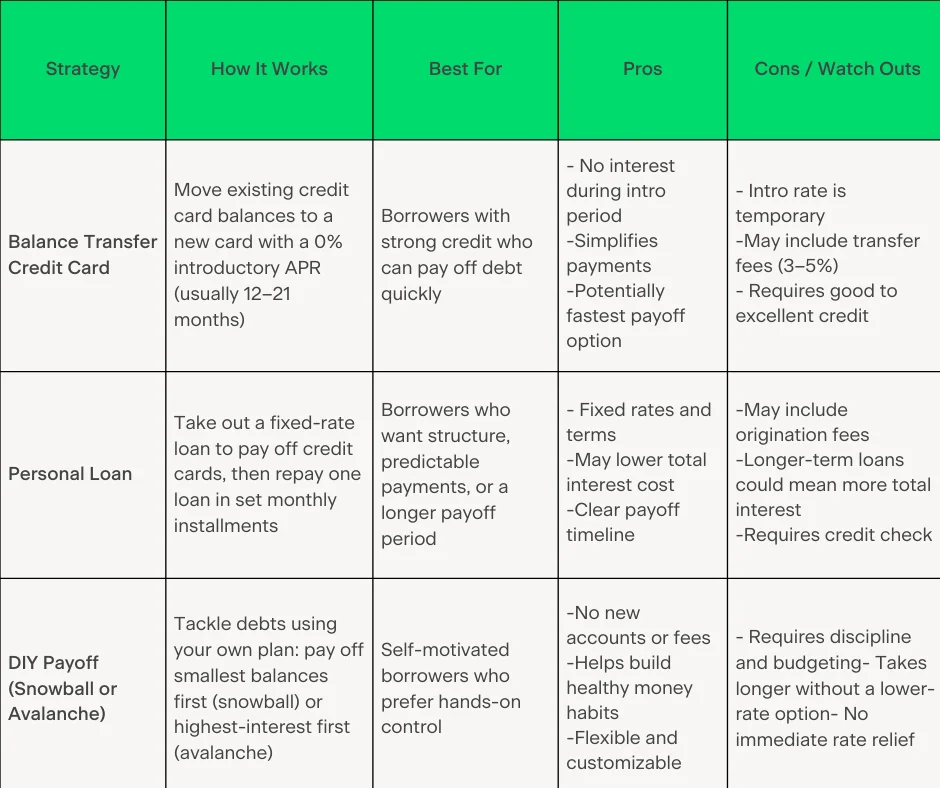

Imagine Sarah, drowning in credit card debt from multiple sources, feeling overwhelmed by hefty interest rates. A balance transfer offers a solution: moving her existing debt from one credit card to another, typically with a lower interest rate or an introductory 0% APR. Essentially, it’s a way to consolidate debt under a more favorable borrowing condition, making repayments more manageable.

How Balance Transfers Can Reduce Debt

When Sarah transferred her balances to a card with a 0% introductory rate for 18 months, she no longer paid interest on her existing debt during that period. This allowed her to allocate every payment directly to the principal rather than interest, accelerating her debt repayment. For many individuals, using such offers strategically reduces the overall cost of borrowing and shortens the time it takes to become debt-free.

Identifying Your Financial Goals

Evaluating Your Current Debt Situation

Before choosing a balance transfer offer, it’s crucial to take stock of your financial standing. Tom, for example, gathered statements from all his credit cards to know exactly how much he owed and at what interest rates. Understanding the total debt amount, monthly minimum payments, and interest rates helps in selecting an offer that fits your needs rather than just chasing the lowest promotional rate.

Setting Realistic Payoff Timelines

Sarah knew she could comfortably pay off $500 a month towards her debt. By calculating how long it would take to eliminate her balances with and without a balance transfer, she avoided unrealistic expectations. Setting a timeline that aligns with your budget is essential to capitalize on the 0% APR period and prevent leftover balances from incurring high interest once the promotional phase ends.

Key Factors to Consider When Choosing a Balance Transfer Offer

Introductory Interest Rates and Time Frames

One of the biggest draws of balance transfer cards is the introductory 0% APR period. However, it’s vital to understand the length of this offer. For instance, John noticed a card offering 0% APR for 21 months, which suited his plan better than another offering 0% for just 12 months. Longer periods give more breathing room to repay without added interest, but rates typically rise after the offer expires.

Balance Transfer Fees and Hidden Charges

While a low or zero introductory rate might look appealing, balance transfer fees can eat into your savings. These fees usually range from 3% to 5% of the amount transferred. Lisa transferred $10,000 to a card with a 3% transfer fee, realizing she had to pay $300 upfront. Knowing these fees helps you weigh if the interest saved outweighs the transfer cost.

Credit Limit Restrictions and Impact on Transfers

Another common challenge is credit limits. Mike attempted to transfer all his debt but found the new card’s limit was only half of what he owed. This meant he had to split balances across multiple cards or leave some debt at higher rates. Understanding the credit limit and how it affects the amount you can transfer avoids unexpected surprises and maximizes your savings.

Comparing Popular Balance Transfer Cards

Top Cards for Low Interest Periods

Cards like the Chase Slate and Citi Simplicity are renowned for offering long 0% APR periods, sometimes stretching beyond 18 months. Many users choose these cards specifically for the extended time to pay down balances without interest. However, these cards often include balance transfer fees, so users weigh the savings against the fee cost carefully.

Cards with No Transfer Fees

For some, the upfront cost of fees matters more than the promotional length. Cards such as the Wells Fargo Reflect sometimes waive transfer fees during promotional periods, appealing to those with moderate balances who want to avoid immediate charges. This can make a significant difference, especially if your debt size is smaller or if you plan to pay it off quickly.

Rewards and Perks to Consider

While the core purpose of balance transfers is debt reduction, some cards add value through rewards. For example, a card might offer cashback on purchases or travel points alongside its balance transfer offer. Though these perks don’t directly reduce your debt, they can add financial incentives that make the card more attractive if you can manage your spending responsibly.

Calculating Cost Savings and Potential Risks

Using Balance Transfer Calculators

Before committing, tools like balance transfer calculators provide valuable insights. Susan used one to estimate how much she’d save in interest by transferring $8,000 and paying $400 monthly. The calculator helped her see that despite a 3% transfer fee, she would save over $1,200 in interest compared to keeping the old card. These tools make abstract terms concrete, aiding in decision-making.

Understanding the Impact of Post-Promo Rates

It’s easy to get comfortable during the interest-free period, but awareness of the standard variable APR after that is crucial. If the balance isn’t fully paid off, the remaining debt may suddenly face rates above 20%. Mark forgot this detail and ended up paying more in interest during the months after his promotional period ended, underscoring the importance of a repayment plan.

Common Pitfalls to Avoid

Many fall into traps like continuing to use the new card for purchases, which may not have the same 0% APR and can add to debt. Others miss payment deadlines, accidentally triggering penalty APRs that invalidate the introductory rate. Being mindful of these mistakes ensures the balance transfer strategy works rather than worsens your financial position.

Step-by-Step Guide to Applying for a Balance Transfer Card

Checking Your Credit Score

Linda realized her credit score would heavily influence the type of offer she could receive. Before applying, she used a credit monitoring service to review her score and clean up any errors. Higher scores tend to unlock better deals with lower fees and longer promotional periods, making this a critical first step.

How to Initiate a Balance Transfer

Once approved, Sarah contacted her new card issuer or used their online platform to request the transfer. She supplied details of her existing cards and the amounts to move. The process typically takes a few days, during which it’s important to keep making minimum payments on old cards until the transfer is confirmed to avoid penalties.

Managing Your New Account Effectively

After the transfer, Mark set up automatic payments to ensure he met deadlines and avoided interest. He also refrained from using the new card for purchases, keeping his focus on reducing the balance. Proper account management maximizes the benefits of the balance transfer while safeguarding your credit health.

Conclusion: Making the Best Decision for Your Financial Health

Choosing the right credit card balance transfer offer requires more than just spotting the lowest interest rate. By understanding your current debt, aligning offers with your payoff timeline, and being aware of fees and limits, you can craft a practical strategy to minimize debt effectively. Real-life stories like those of Sarah, Tom, and Mark show that thoughtful planning and disciplined execution turn these offers from marketing gimmicks into genuine tools for financial recovery. The key is to stay informed, be realistic, and keep your long-term goals in focus as you navigate your path to debt freedom.