Understanding Dollar-Cost Averaging (DCA) in Crypto

What is Dollar-Cost Averaging?

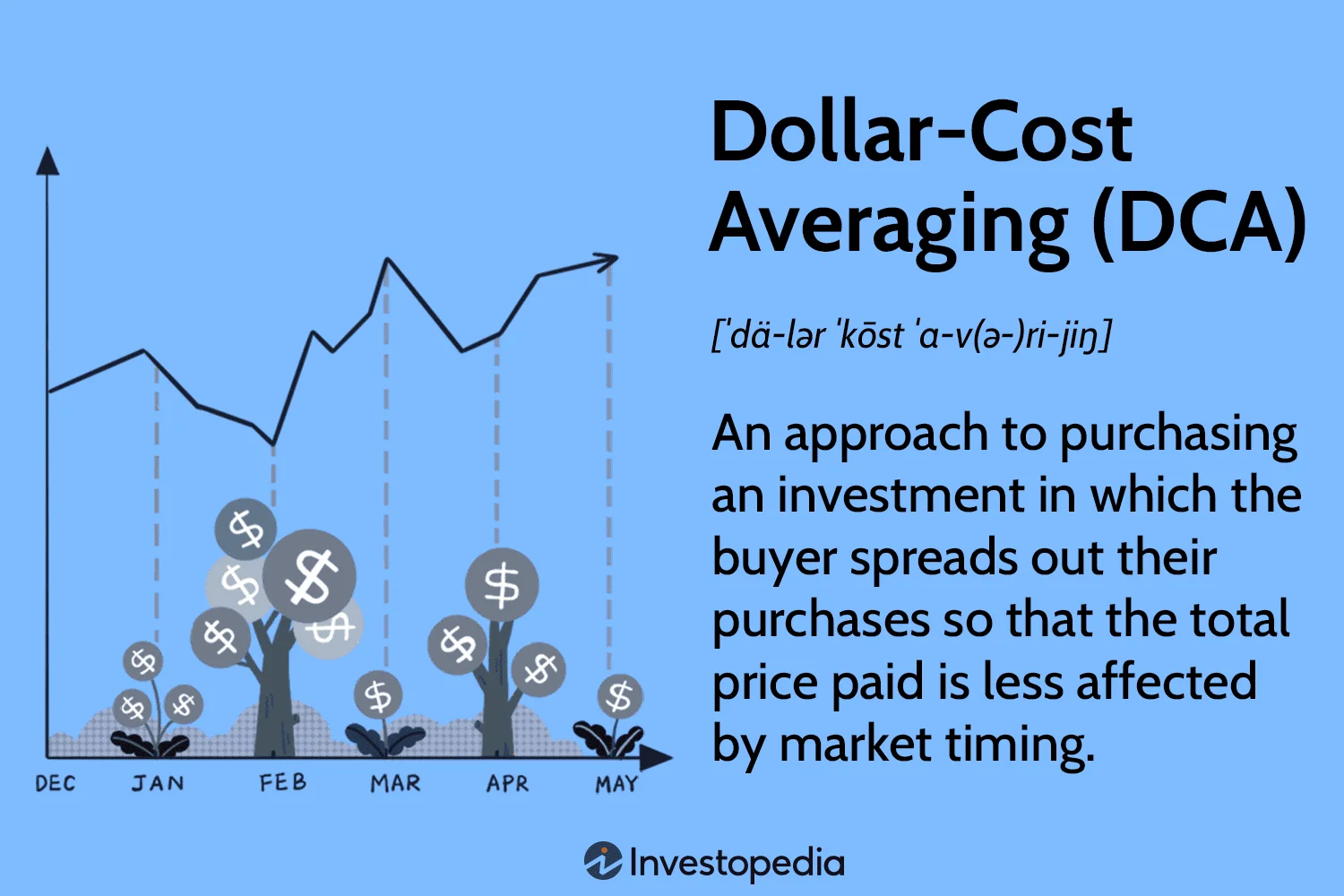

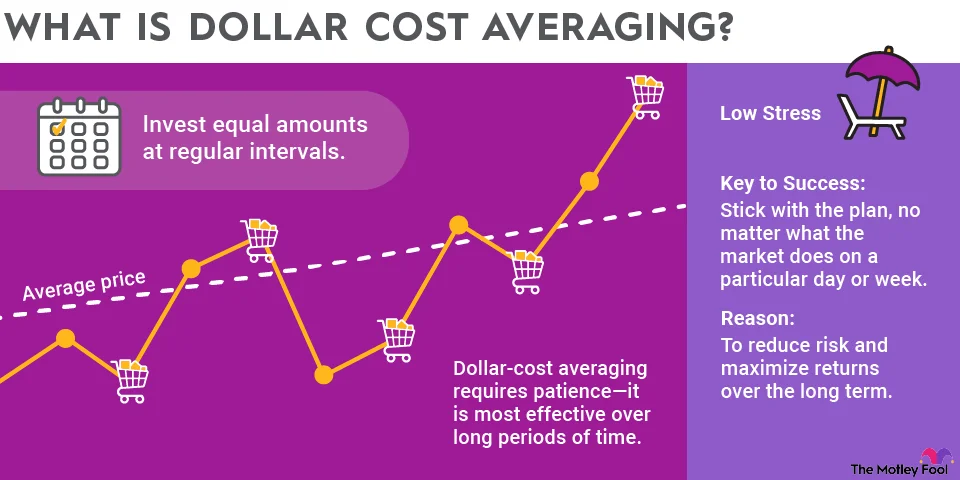

Dollar-cost averaging, often abbreviated as DCA, is an investment strategy where an individual invests a fixed amount of money into an asset at regular intervals, regardless of the asset’s price at each purchase. In the context of cryptocurrency, this means consistently buying a certain dollar value of coins like Bitcoin or Ethereum on a weekly or monthly basis, rather than investing a lump sum all at once. This approach aims to reduce the risk of making poorly timed investments during periods of high volatility, which is common in crypto markets.

The Psychology Behind DCA and Investor Behavior

Investing in cryptocurrencies can be emotionally taxing due to extreme price swings. Many investors fall prey to emotional decision-making, reacting impulsively to market highs and lows, which often leads to buying at peaks and selling during downturns. DCA helps mitigate these psychological challenges by enforcing a disciplined, automated buying routine. It removes the pressure of attempting to time the market perfectly, allowing investors to focus on steady accumulation rather than short-term gains or losses.

Benefits of Applying DCA to Cryptocurrency Investments

Risk Reduction Through Consistent Investment

One of the primary risks in crypto investing is market volatility, which can cause drastic price fluctuations in short periods. When investors attempt lump-sum purchases, they risk entering the market at an unfavorable price point, exposing their capital to significant short-term losses. DCA spreads the investment over time, thereby averaging out the purchase price and reducing the likelihood of suffering a substantial immediate loss due to sudden market drops.

Mitigating Volatility in the Crypto Market

The cryptocurrency market often experiences sharp and unpredictable price changes caused by factors such as regulatory announcements, technological developments, or market manipulation. Holding off on investing or trying to predict market bottoms can lead to missed opportunities or emotional mistakes. By adopting DCA, investors maintain consistent exposure to the market, smoothing out the impact of volatility and preventing reactionary investing based on short-term price surges or plunges.

Long-Term Wealth Accumulation

Due to the speculative nature and evolving landscape of cryptocurrencies, long-term growth potential is best realized by maintaining persistent investments over time. Dollar-cost averaging supports this by fostering steady portfolio growth and encouraging investors to commit funds regularly. This approach aligns well with the nature of cryptocurrencies such as Bitcoin and Ethereum, which have demonstrated growth trends over multiple years, making DCA a strategy conducive to building wealth methodically.

Step-by-Step Guide to Implementing DCA in Crypto

Selecting Cryptocurrencies Suitable for DCA

Choosing the right cryptocurrencies is essential for a successful DCA plan. Investing in well-established coins with a history of long-term growth and stability, like Bitcoin (BTC) or Ethereum (ETH), tends to be safer than selecting smaller altcoins that may have more erratic price behavior or risk disappearing altogether. Conducting thorough research on token fundamentals and market trends helps minimize risks associated with volatility and unforeseen project failures.

Determining Investment Amounts and Intervals

Setting fixed dollar amounts for each investment and deciding on a consistent schedule are critical components of DCA. The investment amount should be affordable and based on discretionary income, ensuring that even during market downturns, you can continue investing without compromising financial stability. Intervals can vary from daily to monthly purchases, depending on personal preferences and the volatility of the assets selected. A consistent schedule helps avoid emotional investing and irregular buying patterns.

Choosing the Right Platforms and Tools for Automation

Automation is key to removing emotional biases and maintaining discipline in a DCA strategy. Many cryptocurrency exchanges offer recurring buy options that automatically execute purchases at set intervals. Selecting platforms with low fees, transparent pricing, and secure custody options is crucial to minimizing costs and protecting holdings. Additionally, using wallets with strong security features, such as biometric authentication or self-custody, enhances the safety of your investments.

Common Challenges and How to Overcome Them

Market Fluctuations and Emotional Reactions

One challenge investors face is resisting the urge to deviate from their DCA plan during periods of extreme market volatility. It’s natural to feel anxious when the portfolio value temporarily declines, leading some to halt investments or panic sell. Recognizing that DCA is designed to weather these downturns by averaging purchase prices can help maintain discipline. Staying committed and avoiding emotional reactions preserves the benefits of gradual accumulation and long-term growth.

Dealing with Transaction Fees and Costs

Frequent small purchases can sometimes incur higher cumulative fees compared to lump-sum investments. This issue arises particularly when using exchanges with high fees or poor exchange rates. To mitigate this, investors should research platforms offering low or no hidden fees, use funding methods with minimal charges, and periodically compare rates across exchanges. Being mindful of these costs ensures that transaction fees don’t erode overall investment returns.

Adjusting Strategy During Bull and Bear Markets

While DCA encourages consistent investing regardless of market conditions, there may be times when adjusting the investment amount or interval is prudent. For example, during prolonged bear markets, reassessing your financial capacity and risk tolerance can prevent overcommitment. Conversely, in a bull market, maintaining regular investment helps capture gains without chasing prices impulsively. Regularly reviewing your DCA plan allows you to align it with evolving financial goals and market environments without abandoning the core strategy.

Advanced Strategies to Enhance Your DCA Approach

Combining DCA with Technical Analysis

For investors seeking to optimize DCA, integrating technical analysis can add an additional layer of decision-making. By monitoring price trends and key support or resistance levels, some may adjust the timing or size of their investments to slightly favor more advantageous price points. However, it’s important to avoid excessive attempts to time the market, which can negate the benefits of a disciplined DCA plan. Used judiciously, technical insights can complement DCA without compromising consistency.

Incorporating Portfolio Diversification

Diversifying across multiple cryptocurrencies and even other asset classes can enhance risk management alongside DCA. Spreading investments among established coins and a limited number of promising altcoins lowers exposure to any single asset’s downturn. Balancing portfolio weightings and periodically rebalancing maintains alignment with risk tolerance and investment objectives. Diversification ensures that the benefits of dollar-cost averaging are not undermined by concentration in volatile or risky tokens.

Measuring the Success of Your DCA Strategy

Tracking Performance Against Lump-Sum Investing

Evaluating how your DCA strategy compares to one-time lump-sum investments provides insight into its effectiveness. While DCA may reduce risk and emotional stress, it does not guarantee higher returns. By maintaining records of purchase prices and timing, investors can analyze average cost basis and overall portfolio performance over various market cycles. This comparison helps set realistic expectations and informs adjustments to the investment approach.

Tools and Metrics for Monitoring Progress

Several platforms and portfolio trackers offer features to monitor DCA performance, including automatic cost basis calculations and real-time market valuations. Investors should use tools that provide transparent reporting on fees, investment intervals, and asset allocations. Regularly reviewing these metrics supports informed decision-making and ensures your strategy adapts to changing financial goals and market conditions.

Bonus: Real-Life Case Studies of DCA in Crypto

Success Stories

Numerous investors have demonstrated how consistent dollar-cost averaging into top cryptocurrencies like Bitcoin led to significant gains over time. By staying disciplined during price corrections and avoiding impulsive trading, these individuals gradually increased their holdings while lowering average purchase costs. Their experiences highlight how patience and routine investing can build wealth even in the volatile crypto market.

Lessons Learned from Mistakes

Some investors have stumbled by abandoning their DCA plans during market downturns or attempting to time purchases based on short-term speculation. Others failed to account for fees or neglected to secure their assets properly, resulting in losses or compromised holdings. These cautionary tales underscore the importance of commitment, due diligence, and choosing reliable tools to support a successful dollar-cost averaging strategy in cryptocurrency investing.