Understanding Travel Insurance and Flight Cancellations

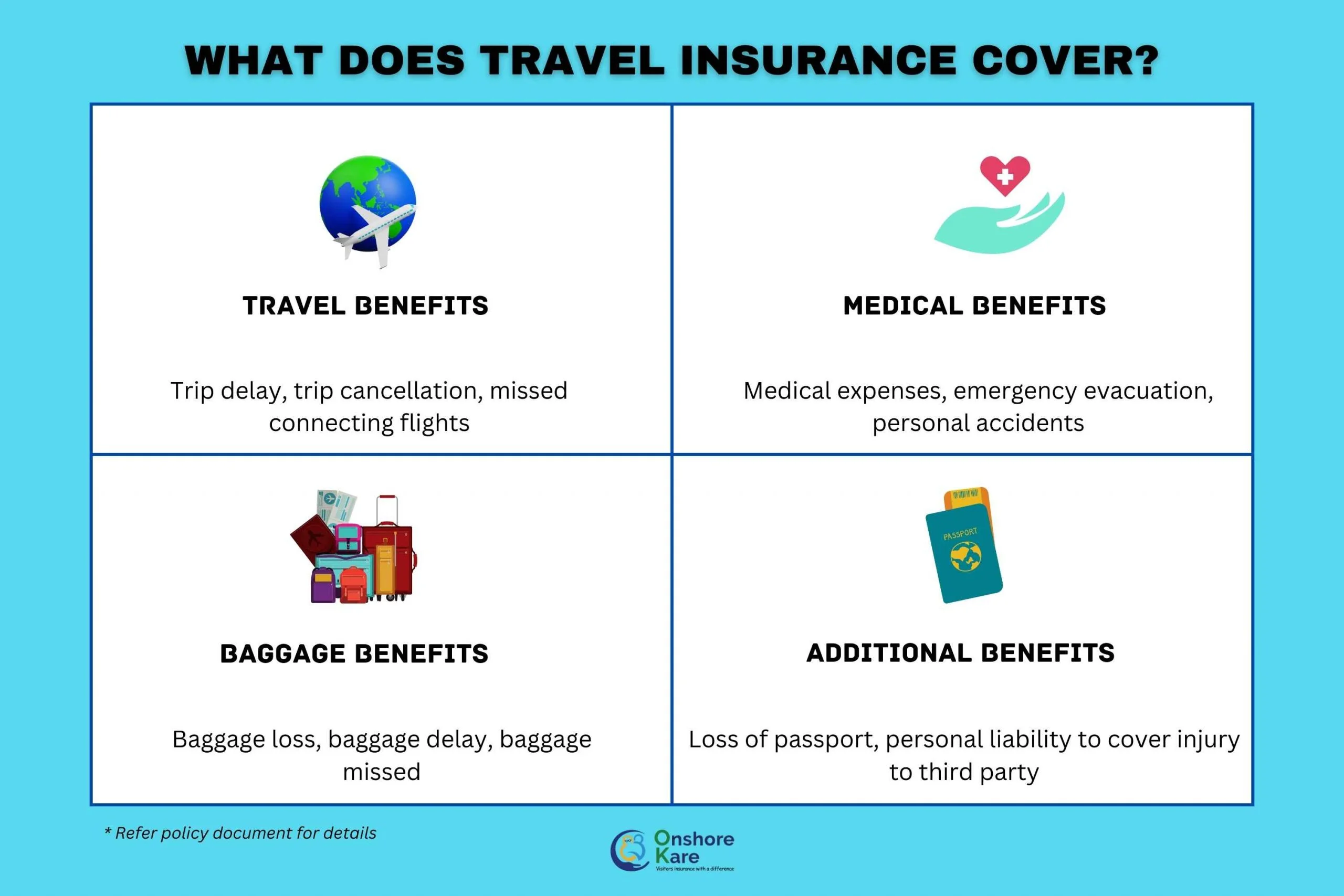

What Does Travel Insurance Cover?

Travel insurance is designed to protect travelers from unexpected disruptions that can occur before or during a trip. When it comes to flight cancellations, a well-rounded travel insurance policy generally covers trip cancellations or delays, lost or stolen luggage, medical emergencies, emergency evacuations, and travel interruptions triggered by unforeseen circumstances. These insurance plans often include coverage for specific causes such as issues with the destination, covered medical emergencies, or even loss of employment, offering peace of mind for travelers navigating uncertain situations.

Common Reasons for Flight Cancellation

Flight cancellations can stem from a variety of causes, many of which are unpredictable and beyond the traveler’s control. Weather-related disruptions, mechanical failures, airline operational issues, or problems at the destination such as political unrest or natural disasters frequently result in canceled flights. Additionally, medical emergencies or injuries requiring prompt attention and other covered reasons as outlined in the travel insurance plan can also lead to a canceled flight. Understanding these common causes is crucial because not all reasons for cancellation will automatically qualify for insurance reimbursement, emphasizing the need to carefully review the policy terms.

Initial Steps to Take When Your Flight Is Canceled

Contacting the Airline and Gathering Documentation

The moment your flight is canceled, your first action should be to reach out to the airline to confirm the cancellation and obtain official documentation. This can include a cancellation notice or confirmation email, which serves as essential proof when filing your travel insurance claim. Securing this information quickly ensures you meet any time-sensitive requirements for notifying travel suppliers, often within 72 hours, and helps establish the legitimacy of your claim.

Notifying Your Travel Insurance Provider

Simultaneously, it is important to alert your travel insurance provider promptly. Contacting Allianz Partners, for example, as soon as possible after your flight cancellation allows you to seek confirmation on whether your situation qualifies for coverage and to receive guidance on the next steps. Early communication with your insurer can prevent common pitfalls such as missing claim deadlines or submitting incomplete documentation, both of which can jeopardize your reimbursement.

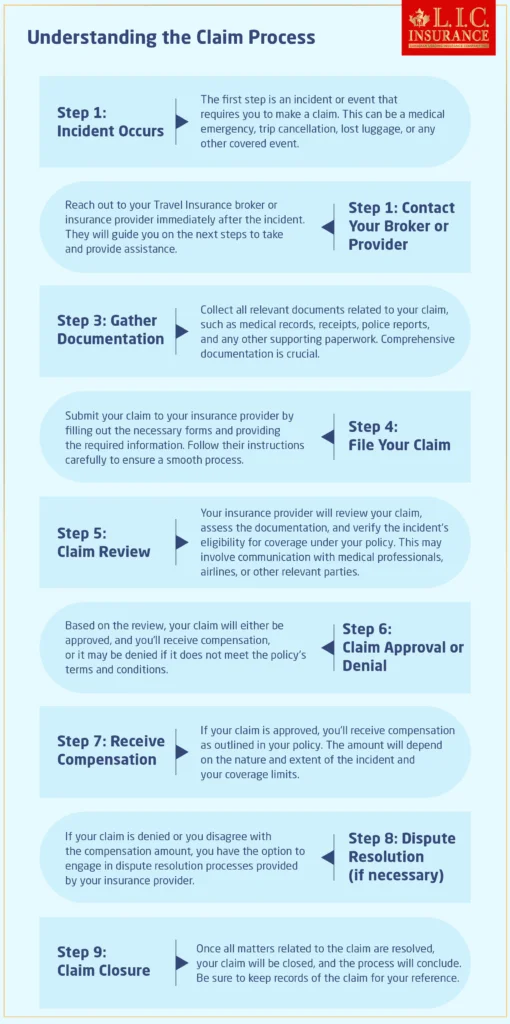

Step-by-Step Process for Filing Your Travel Insurance Claim

Step 1: Review Your Policy and Coverage Details

Begin by thoroughly reviewing your travel insurance policy to understand the specific coverage limits, exclusions, and deadlines that apply to trip cancellations due to flight disruptions. This step helps you verify whether your reason for cancellation is covered and prepares you to complete the claim process accurately. Misunderstandings at this stage are a frequent cause of claim denials, so careful attention is critical.

Step 2: Collect Necessary Evidence and Receipts

Next, gather all necessary documentation to support your claim. This includes airline cancellation notices, receipts for any prepaid expenses, proof of payment for your travel insurance, and, if applicable, a physician’s note or medical records for covered medical issues related to the cancellation. Keeping both digital and physical copies of these documents ensures you have reliable proof to submit, speeding up the claim evaluation.

Step 3: Fill Out the Claim Form Accurately

Filling out the claim form requires careful attention to detail. Provide honest and precise information to avoid delays caused by inaccuracies or missing details. Complete the form as instructed, and if you have any doubts about specific sections, consult your insurer to clarify requirements. Accurate completion of this form lays the foundation for a smooth claims process.

Step 4: Submit the Claim via Online Portal or Mail

Once your documents and claim form are ready, submit your claim through the insurer’s preferred method, whether that is via an online portal like Allianz Partners’ claim management tool or by mail. Electronic submission often speeds up processing, and many insurers provide apps such as the Allyz® app for convenient claim tracking. Confirm that all required attachments are included before submission to prevent delays.

Step 5: Follow Up and Track Your Claim Status

After submission, it is essential to actively monitor the status of your claim. Utilize available online tools or apps to track progress, and promptly respond to any requests for additional information from the insurer. Staying engaged throughout this phase helps ensure your claim moves efficiently toward approval and reimbursement.

Tips to Speed Up Your Travel Insurance Claim Approval

How to Avoid Common Mistakes

Many travelers unintentionally slow down their claim process by canceling trips before confirming coverage, or by failing to alert travel suppliers within required timeframes. Avoid these pitfalls by thoroughly reading your insurance policy ahead of time and acting swiftly after a cancellation. Missing or incomplete documentation is another frequent error, so maintain organized records and submit comprehensive evidence. Prompt action within deadlines and honest representations of your situation also contribute significantly to smoother approvals.

Communicating Effectively with Your Insurer

Clear and timely communication with your insurance provider is vital. Always have your plan details on hand when contacting them, and don’t hesitate to ask questions about the claim process or required documentation. Being proactive and responsive to insurer inquiries reduces processing delays and demonstrates your commitment to resolving the claim. Additionally, understanding the scope of your coverage can guide you in managing expectations regarding reimbursement.

What to Do If Your Claim Is Denied

Understanding Claim Denial Reasons

It can be frustrating to face a denied claim, but understanding why the insurer rejected your request is the first step toward resolution. Common reasons include submitting claims for non-covered incidents, missing deadlines, incomplete forms, or failing to provide requested documentation. Sometimes policy exclusions or lack of qualifying cause for cancellation are the underlying issues. Identifying the specific cause of denial allows you to address deficiencies effectively.

Appealing the Decision and Next Steps

If your claim is denied, don’t give up immediately. Many insurers allow you to appeal the decision by submitting additional evidence or explanations. This may involve gathering further documentation, obtaining an apostille for international claims to authenticate documents, or providing a more detailed account of your situation. Working with reliable documentation centers to legalize paperwork can strengthen your appeal. Throughout this process, maintain clear communication with your insurer and seek any available support to improve your chances of a successful outcome.