Introduction to the Envelope Budgeting System

What is the Envelope Budgeting Method?

The envelope budgeting system is a straightforward, hands-on method of managing family finances by dividing your budget into distinct spending categories—each represented by an envelope. Whether physical envelopes filled with cash or digital versions managed through an app, this system is designed to help families allocate specific amounts for expenses such as groceries, utilities, and entertainment. By limiting spending to the money within each envelope, it encourages conscious budgeting and prevents overspending.

Imagine a family of four: after the monthly income is received, the parents sit down and allocate fixed amounts to envelopes for groceries, gas, and children’s activities. Once the cash in an envelope is depleted, they know the spending category is closed until the next budget cycle. This visualization creates a tangible connection to spending habits and promotes mindful money management.

Benefits of Using This System for Families

Families often struggle with tracking variable expenses like dining out or school supplies. The envelope budgeting system addresses this challenge by providing clear boundaries on spending, which can prevent surprises at the end of the month. For instance, a family that formerly saw inconsistent utility bills and sporadic grocery spending reported feeling more in control and less stressed after adopting envelopes.

Beyond control, it also fosters communication among family members about money. Kids can learn the basics of budgeting by managing their own envelopes for allowances or weekend outings. Overall, this approach reduces financial anxiety and promotes teamwork when managing household expenses.

Preparing Your Family Budget

Analyzing Monthly Income and Expenses

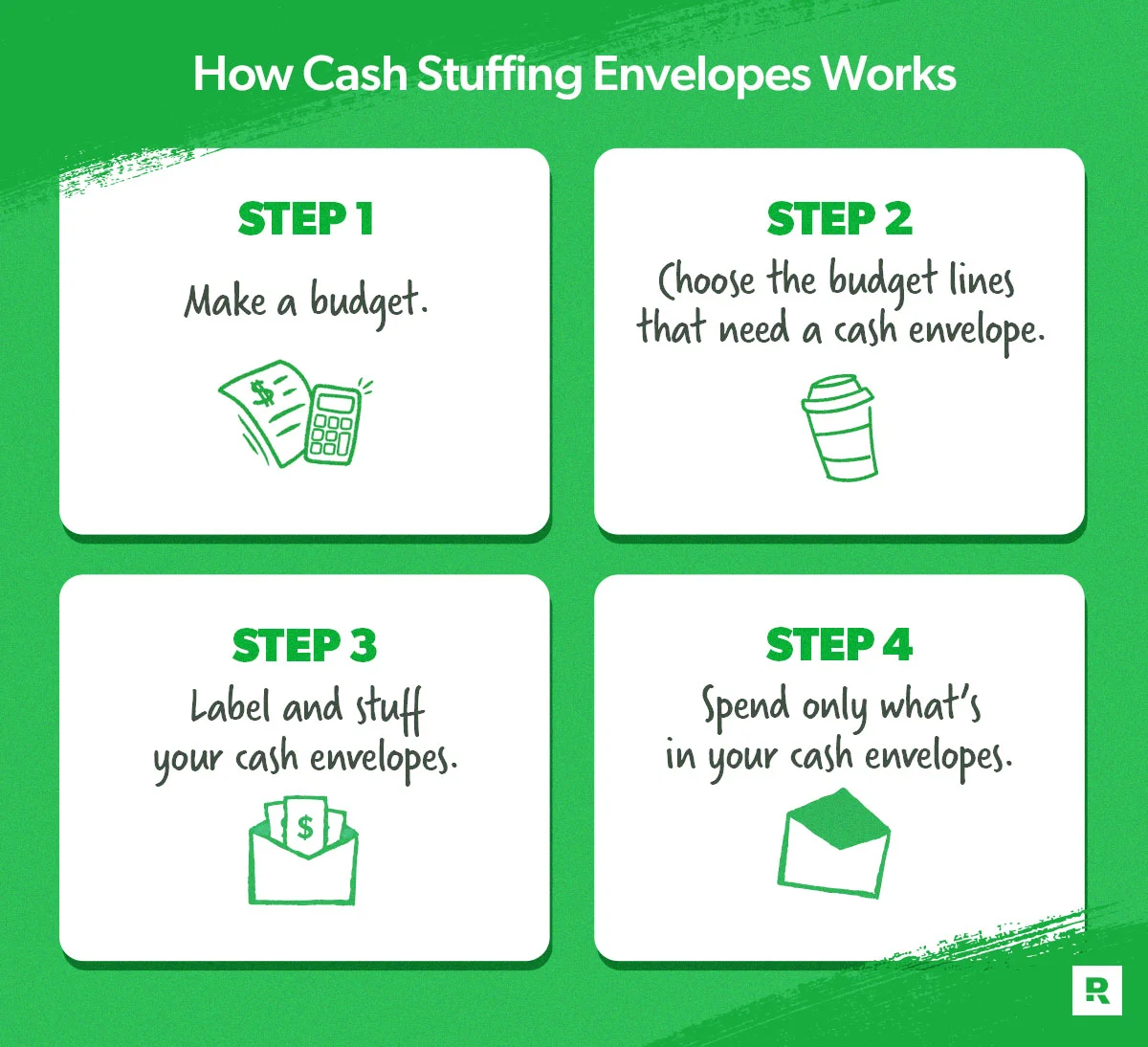

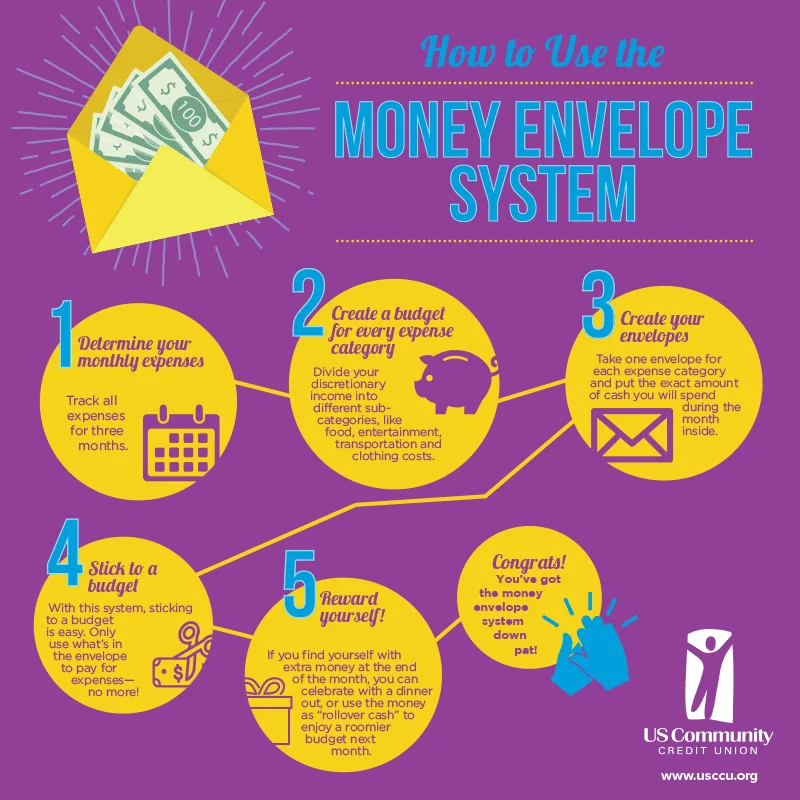

The first step in implementing the envelope system is to take a realistic look at your family’s income and expenses. Start by calculating your monthly take-home pay, including salaries, freelance earnings, or other income sources. Then, gather bank statements and bills to identify fixed costs such as rent, utilities, and car payments, along with variable expenses that fluctuate each month.

For example, a family might discover that dining out and entertainment were the biggest sources of overspending. This analysis sets the stage for creating envelopes that address where money is actually going, so you can allocate funds more effectively.

Identifying Spending Categories

Next, divide your expenses into practical categories. Common categories include groceries, transportation, healthcare, education, entertainment, and savings. It’s important to be thorough and include occasional expenses such as gifts or car maintenance, which often catch families off guard.

One practical tip is to add a miscellaneous envelope to cover unplanned expenses—this helps avoid dipping into other envelopes unnecessarily. At this point, gather the family to discuss which categories matter most to everyone, ensuring the budget reflects shared priorities.

Creating Envelopes for Each Expense Category

Physical vs. Digital Envelope Methods

Choosing between physical envelopes and digital ones often depends on comfort and convenience. Physical envelopes, stuffed with cash, offer a tactile experience that some find motivating. For example, a family that was wary of overspending on credit cards switched to cash envelopes for discretionary spending and reported better control.

However, many prefer digital apps that simulate envelopes for debit and credit transactions. These apps can track spending in real-time and send alerts when limits are close. This method is especially helpful for those uncomfortable carrying cash or for families with multiple card users.

Deciding the Number of Envelopes Needed

There’s no fixed number of envelopes; it depends entirely on your family’s spending pattern. Some might find 10 envelopes sufficient, while larger families with more complex expenses may require 20 or more. For example, a couple with two teens might include envelopes for teen activities, school supplies, and personal care, while a single-parent household may combine certain categories for simplicity.

It’s best to start with broader categories and refine over time. Adding too many envelopes initially can feel overwhelming, so adjusting to what works practically helps maintain consistency.

Allocating Funds to Each Envelope

Determining Envelope Amounts Based on Priorities

Allocating funds should be based on historical spending data and family priorities. For instance, if groceries usually take up 25% of the budget, that percentage should reflect in the envelope amount. Families facing debt may choose to allocate a smaller amount for dining out to funnel more money toward debt repayment.

Consider involving everyone in the decision-making process to align spending with what matters most. When a teenage daughter wants more money for extracurricular activities, parents might reallocate envelopes to accommodate this wish while trimming elsewhere.

Adjusting Allocations for Family Size and Needs

Family size greatly influences budgeting. A household with young children will likely allocate more for childcare and health than a couple without kids. Seasonal expenses, like school fees or holiday gifts, should also be factored in by smoothing those costs across the year or creating specific envelopes.

As children grow, their needs change. For example, transportation costs might rise once teens start driving. Regular reviews ensure envelope amounts reflect these evolving needs, avoiding surprises that could derail the budget.

Managing Daily and Monthly Expenses

Tracking Spending Using the Envelopes

Tracking expenses is crucial for success. With physical envelopes, each purchase reduces cash available in that envelope, offering immediate feedback. Families often share responsibility by having different members manage envelopes related to their spending, like the spouse handling utilities and the parent managing groceries.

For digital users, logging transactions daily ensures accuracy. One family used a spreadsheet to complement their app tracking, updating it every evening to balance cash flow and spot any overspending early.

Tips for Staying Within Budget Limits

Sticking to envelope limits can be challenging—especially when unforeseen expenses arise. Setting conservative spending limits encourages saving leftover funds for debt payments or emergencies. If leftover money remains in an envelope, rolling it over to the next period or into a dedicated savings envelope builds financial cushion over time.

Also, families paid biweekly can split monthly budgets accordingly, avoiding overspending early in the pay cycle. This adaptive budgeting reduces stress and keeps spending anchored to real income rather than expectations.

Adjusting Your Envelope Budget Over Time

Reviewing and Modifying Envelope Amounts

Regular review sessions are essential to keeping your envelope system effective. At the end of each month, families should examine which envelopes consistently run out early and which have surplus. If groceries are stretched thin monthly, it’s time to increase that envelope and reduce less pressing categories.

Life changes, such as a new job, a baby, or moving house, require budget tweaks. Flexibility ensures the envelope system continues to support your financial goals rather than becoming a rigid constraint.

Handling Unexpected Expenses

Unplanned costs can disrupt any budget. Having an emergency envelope or a “miscellaneous” category helps manage these without breaking other envelopes. For instance, when a family car needed a sudden repair, they used funds from the emergency envelope instead of borrowing or using credit.

When emergencies surpass allotted amounts, consider adjusting future budgets to replenish these funds gradually. Using leftover paychecks, like a third paycheck in a biweekly system, for emergencies or debt repayment adds a strategic cushion.

Tools and Resources to Support Envelope Budgeting

Recommended Apps for Envelope Budgeting

Several budgeting apps are tailored to the envelope method. Apps like Goodbudget and Mvelopes allow families to create virtual envelopes linked to bank accounts or debit cards. These apps send notifications, making it easier to avoid overspending and manage multiple envelopes without handling cash.

Other apps offer features useful for families, such as shared accounts or multiple user profiles, so everyone can stay informed about the budget’s status in real time.

Printable Envelope Templates for Families

For those using physical envelopes, printable templates can organize spending neatly. Numerous online resources offer customizable sheets where you can write categories, spending limits, and track balances. These templates are especially helpful for families new to envelope budgeting, providing a structured yet flexible tool to record transactions.

Using bright colors or labels on envelopes can engage children, turning budgeting into a family learning activity rather than a chore.

Common Challenges and How to Overcome Them

Involving Family Members in the Budget Process

One common hurdle is ensuring all family members understand and commit to the envelope system. Resistance can come from children or spouses uncomfortable with change or strict limits. Creating a family meeting to discuss budgeting goals and how each member can contribute fosters cooperation.

Assigning responsibility for specific envelopes to different family members encourages ownership. For example, teenagers managing their own envelopes for entertainment teaches money management early on while freeing parents from micromanaging every expense.

Maintaining Discipline and Consistency

Discipline can falter when life gets busy or unexpected temptations arise. One family overcame this by setting reminders and reviewing envelopes weekly instead of monthly, catching overspending before it snowballed. The physical act of handing over cash creates a natural pause before spending, reinforcing restraint.

It’s also vital to accept that perfection is unlikely. Occasional overruns happen—what matters is learning and adjusting. Celebrating small wins, like successfully sticking to the grocery envelope for a month, motivates continued effort.

Conclusion: Achieving Financial Harmony as a Family

Using the envelope budgeting system can transform family finances from unpredictable to manageable. It provides structure that helps control overspending, increases financial awareness, and encourages saving. Through regular adjustments, involvement of all household members, and mindful tracking, many families find greater harmony and reduced stress around money.

Whether managing with cash envelopes or digital tools, this method adapts to your unique situation, making budgeting less intimidating and more effective. By taking it step-by-step and committing as a family, financial goals become achievable, turning budgeting from a source of tension into a path for shared success.