Understanding the Importance of Lowering Interest Rates

The Impact of High Interest Rates on Debt

High credit card interest rates can significantly increase the total amount repaid over time, making it difficult to reduce the principal balance. When rates average between 21.76% and 23.3%, a substantial portion of each payment goes toward interest rather than the actual debt. This prolongs the repayment period and can trap borrowers in a cycle where debt seems unmanageable, especially when only the minimum payments are made. As interest compounds, balances grow, leading to increased financial strain and a prolonged payoff timeline.

When to Consider Negotiating with Creditors

Negotiation becomes crucial when financial difficulties arise, such as job loss, salary reductions, or unexpected expenses like medical bills. Additionally, those juggling multiple credit cards with varying interest rates may find overall interest payments ballooning unnecessarily. If you find yourself using credit cards for daily necessities or struggling to keep up with payments, it’s a clear sign to approach your creditors. Negotiating lower rates can create breathing room, reduce monthly payments, and ultimately accelerate debt repayment.

Preparing for Your Negotiation

Gathering Financial Documents and Credit Information

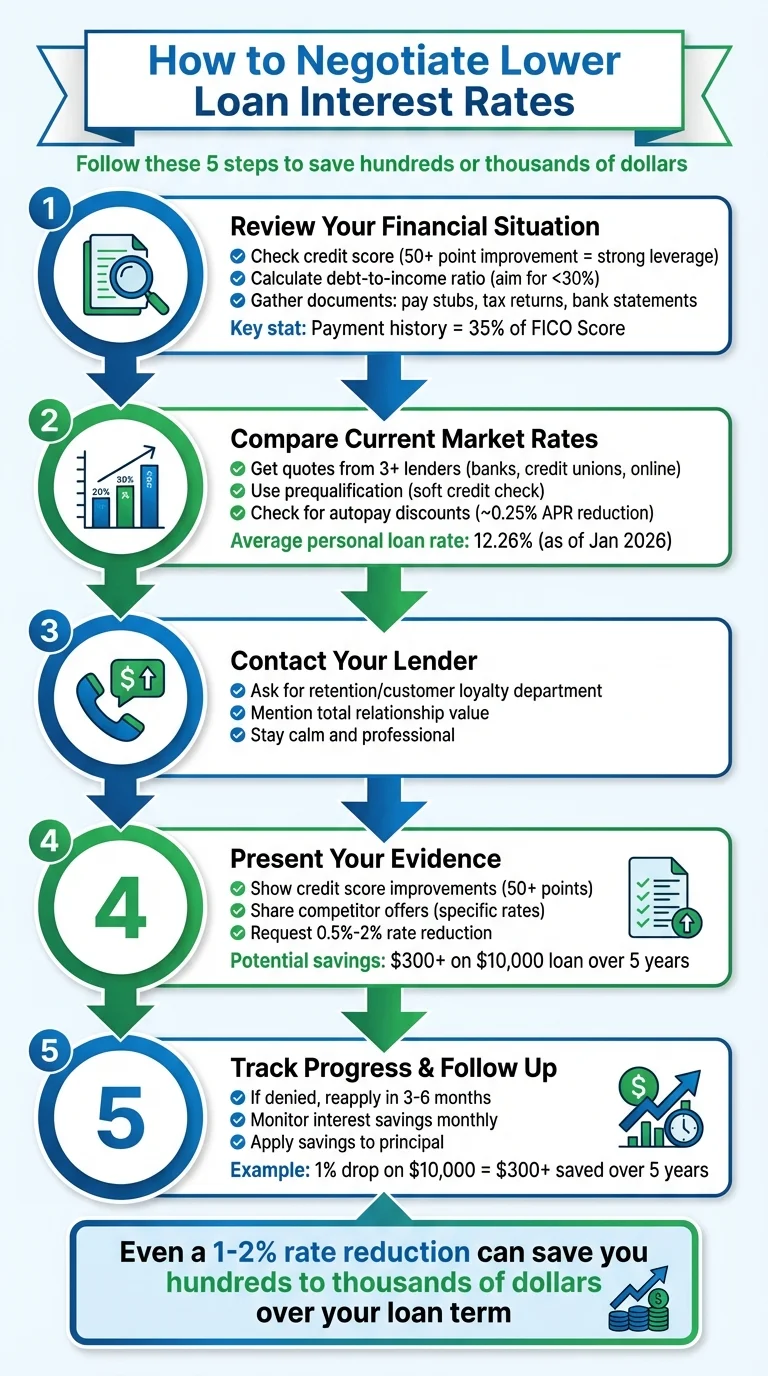

Preparation is key to a successful negotiation. Start by collecting recent credit card statements to understand your current interest rates and balances. It’s also important to know your credit score, ideally around 700 or above, to strengthen your position. Having competing credit card offers with lower interest rates on hand provides leverage during discussions. Moreover, documenting personal circumstances such as recent financial hardships or improvements in creditworthiness can support your request for a rate reduction.

Assessing Your Current Financial Situation

Before initiating contact, take a detailed look at your income, expenses, and existing debts. Understanding your ability to make payments helps in setting realistic goals during negotiation. Analyze which cards carry the highest interest rates and consider prioritizing those in your repayment plan. Using the debt avalanche method—focusing extra payments on higher-rate cards—can maximize interest savings and reduce debt faster. Knowing your financial limits prevents overpromising and builds credibility with creditors.

Setting Realistic Goals and Limits

Establish clear objectives for the negotiation, such as aiming for an interest rate below the average of 22.25% as of May 2025. It’s also wise to determine the minimum acceptable terms beforehand. If a permanent reduction isn’t feasible, ask for a temporary interest rate decrease to ease immediate financial pressure. Setting limits prevents accepting unfavorable terms and ensures your negotiation is both strategic and beneficial.

Effective Communication Strategies

How to Approach Creditors Professionally

Politeness and professionalism are essential when communicating with creditors. Begin calls courteously, clearly stating your intent to discuss your account. Maintaining a calm and friendly tone helps foster cooperation. Avoid threats such as canceling cards, which can worsen your credit standing and reduce negotiation power. Being patient and respectful opens the door for constructive dialogue and increases the likelihood of favorable outcomes.

Key Phrases and Language to Use

Using clear, confident language that highlights your responsible payment history and recent improvements in your credit score can strengthen your position. Mentioning competing offers with lower rates shows you are informed and serious. Phrases like “I’ve been a loyal customer,” or “Given my recent financial challenges, I’m seeking a rate adjustment to continue timely payments,” convey sincerity and accountability. Avoid aggressive or demanding language, as it can hinder progress.

Step-by-Step Negotiation Process

Initiating Contact and Requesting a Lower Rate

Start by calling the credit card issuer associated with your longest account history and solid on-time payments. Introduce yourself and explain that you would like to negotiate a lower interest rate. Be clear and concise about your intent. If the representative denies a permanent reduction, inquire about the possibility of a temporary rate cut to provide immediate relief. Taking a patient approach at this stage sets a positive tone for the conversation.

Presenting Your Case and Evidence

Support your request by sharing relevant information such as improvements in your credit score or financial hardships affecting your ability to pay. Mention any competing offers from other issuers with lower interest rates to strengthen your argument. Providing specific documentation, if available, adds credibility. Emphasizing your goal to continue timely payments demonstrates your commitment, making creditors more willing to work with you.

Possible Counteroffers and How to Respond

Creditors may propose temporary rate reductions or alternative repayment plans. If the offer doesn’t meet your expectations, politely ask if there is room for further adjustment. If a reduction is declined, request the possibility to revisit the negotiation after a few months, particularly if your financial situation improves. Keep detailed notes of each conversation, and consider calling back after 3 to 6 months to attempt negotiation again. Persistence can often lead to better terms.

Finalizing the Agreement

Once an agreement is reached, ask for written confirmation of the new terms. This protects you from future misunderstandings and ensures the creditor honors the agreed rate. Verify all details carefully, including the effective date and whether the rate is temporary or permanent. Following up with a thank-you note or email fosters goodwill and maintains a positive relationship with your creditor, which can be beneficial for future negotiations.

After Successfully Negotiating a Lower Interest Rate

Reviewing and Documenting the New Terms

After your creditor confirms the lower interest rate, carefully review the documentation received. Ensure that all terms match the verbal agreement and check for any hidden fees or conditions. Retain these documents for your records and regularly monitor your account statements to confirm the correct rate is applied. Staying informed helps prevent surprises and keeps you in control of your financial progress.

Tips to Maintain Good Standing with Creditors

Maintaining a positive payment history after negotiation is crucial. Continue making at least minimum payments on all accounts and prioritize extra payments on the highest interest rate card using the debt avalanche method. Avoid canceling credit cards, as this can negatively impact your credit score and reduce your negotiation leverage in the future. Staying proactive with budgeting and monitoring your financial health supports ongoing favorable terms and credit relationships.

Alternative Solutions If Negotiation Fails

Exploring Debt Consolidation

If negotiating lower rates directly with creditors is unsuccessful, consider debt consolidation options. This may include balance transfers to a new credit card with a lower introductory rate or consolidating debt into a single personal loan with a lower interest rate. Consolidation simplifies payments and can reduce interest costs, but it requires discipline to avoid accumulating new debt. Understanding the terms and potential fees beforehand is essential to making consolidation effective and sustainable.

Seeking Professional Financial Advice

When negotiations and consolidation aren’t sufficient, professional financial advice can provide tailored solutions. Credit counseling agencies offer programs such as Debt Management Plans (DMPs) which negotiate on your behalf to reduce interest rates and create manageable repayment schedules. Services like GreenPath provide free or low-cost counseling to help you regain control of your finances. Utilizing expert guidance ensures you explore all available options and select the most appropriate path toward debt relief.