Understanding Credit Card Debt and Its Impact on Your Credit Score

What Constitutes Credit Card Debt?

Credit card debt is the outstanding balance you owe on your credit cards after making purchases, cash advances, or balance transfers. It accumulates when you do not pay the full statement balance by the due date, resulting in interest charges on the remaining amount. Understanding this is crucial because credit card debt is often revolving, meaning it can fluctuate monthly as new transactions are added and payments are made. This characteristic distinguishes it from fixed debts like loans that have set repayment schedules.

How Credit Card Payments Affect Your Credit Score

Your payment behavior significantly influences your credit score, a key factor lenders use to evaluate your creditworthiness. Timely payments demonstrate reliability and can boost your score, while missed or late payments typically result in penalties and score reductions. Besides payment history, the amount of debt relative to your credit limit, known as credit utilization, also affects your score. High utilization rates may indicate risk and can lower your score, so managing payments strategically is essential to maintaining credit health.

Common Misconceptions About Credit Score and Debt Repayment

Many believe paying off debt quickly always improves credit scores immediately, but this is not necessarily true. For instance, closing a credit card after paying it off can reduce your available credit and increase utilization on remaining cards, which may hurt your score. Another misconception is that carrying small balances boosts credit scores, but experts agree that paying balances in full is preferable. Recognizing these nuances helps avoid actions that unintentionally damage your credit while repaying debt.

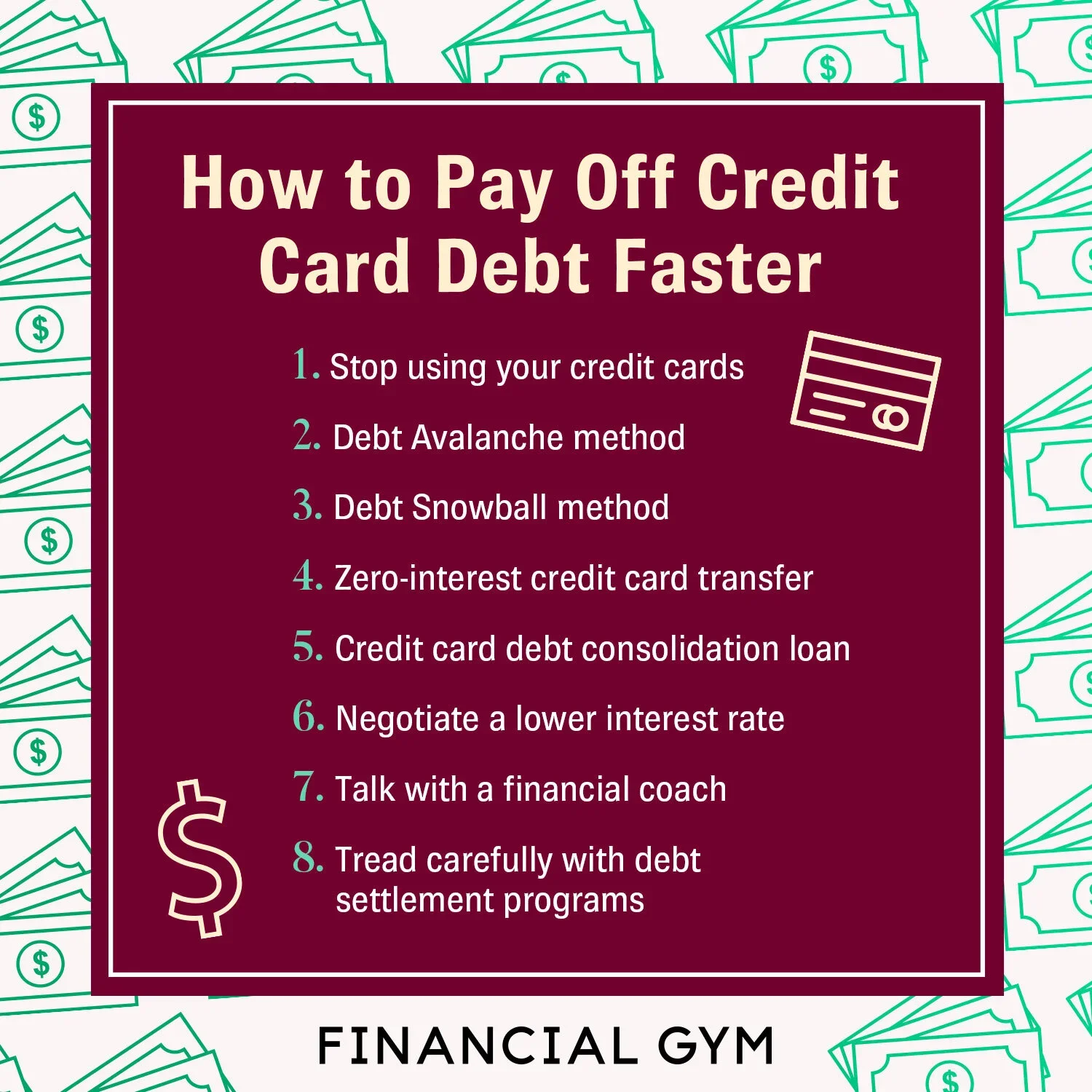

Effective Debt Reduction Techniques That Preserve Credit Health

The Snowball Method: Motivation Through Small Wins

The snowball method focuses on repaying the smallest debts first to build momentum. You allocate extra funds to the smallest balance while making minimum payments on others. This approach allows for quick wins that motivate you to keep going. Over time, as each small debt is cleared, you free up more money to tackle larger balances. Importantly, this method emphasizes consistent payments, which safeguard your credit score by avoiding missed payments and reducing reported balances steadily.

The Avalanche Approach: Minimizing Interest Costs

Unlike the snowball method, the avalanche strategy prioritizes paying off debts with the highest interest rates first. By reducing high-interest balances early, you save money on interest payments, accelerating overall debt payoff. This approach requires discipline since you might not see quick balance reductions initially, but it is financially efficient. Maintaining minimum payments on other debts ensures you stay in good standing with creditors, helping to protect your credit score throughout the process.

Balance Transfers: Pros, Cons, and Credit Score Considerations

Balance transfers allow you to move high-interest credit card debt to a card with a lower or zero introductory APR. This can significantly cut interest costs and speed up repayment. However, balance transfers may involve fees, and applying for new credit can temporarily lower your credit score due to a hard inquiry. Additionally, if the transferred balance is not paid off before the promotional period ends, interest charges can accumulate rapidly. Therefore, balancing these factors is vital to avoid credit damage.

Automated Payments to Avoid Late Fees and Missed Payments

Setting up automated payments for at least the minimum amount helps prevent late payments, which are detrimental to your credit score. Automation reduces the risk of forgetting due dates, ensuring consistent payment history. You can often choose to pay more than the minimum, further accelerating debt reduction. This simple strategy supports both timely payments and steady progress, keeping your credit profile healthy during the payoff journey.

Smart Budgeting and Financial Habits to Accelerate Debt Repayment

Creating a Realistic Budget That Prioritizes Debt

Developing a budget that accurately reflects your income and expenses is the foundation for paying down credit card debt effectively. Begin by listing all sources of income and fixed obligations, then allocate funds to essential living costs. Allocate any surplus toward debt repayment, aiming to pay more than the minimum when possible. This planning helps prevent overspending and ensures that debt reduction remains a priority without causing financial strain.

Cutting Unnecessary Expenses Without Sacrificing Quality of Life

Reducing discretionary spending can free up additional funds for debt payments without compromising your lifestyle dramatically. Evaluate your monthly expenditures and identify areas for trimming, such as subscription services you rarely use or dining out less frequently. Small adjustments cumulatively contribute significant savings. The key is to balance frugality with maintaining your well-being, which supports long-term commitment to your repayment goals.

Building an Emergency Fund to Avoid Future Debt

Having an emergency fund acts as a financial safety net, preventing new credit card debt when unexpected expenses arise. Even a modest fund can cover small emergencies like car repairs or medical bills, reducing reliance on credit cards. Plan to save a small, consistent amount monthly until you have at least three to six months of essential expenses. This precaution preserves your progress in paying down current debt and protects your credit score.

Leveraging Credit Tools and Professional Help Responsibly

Using Personal Loans to Consolidate Debt Safely

Personal loans with fixed interest rates and terms can be a useful tool to consolidate multiple credit card balances into one payment. This simplifies debt management and often lowers interest costs, making repayment more predictable. It is important to shop carefully for loans with favorable terms and avoid extending repayment periods excessively, which can increase total interest. Properly managing this loan ensures your credit score remains stable or improves over time.

When to Consult Credit Counseling Agencies

If managing debt independently becomes overwhelming, consulting a reputable credit counseling agency can provide valuable guidance. These agencies offer budgeting advice, debt management plans, and negotiations with creditors. Engaging with professionals early can prevent worsening financial situations. Ensure you work with certified counselors who prioritize education and ethical practices, as responsible counseling supports credit health rather than damaging it.

Impact of Hard Inquiries and How to Minimize Them

Applying for new credit often triggers hard inquiries, which can temporarily lower your credit score. While one or two inquiries have minimal effect, multiple applications within a short period can be detrimental. To minimize this impact, research offers before applying and limit new credit requests. When consolidating debt through loans or balance transfer cards, timing applications strategically can preserve your credit score during the repayment process.

Signs You’re Successfully Paying Down Your Debt Without Credit Damage

Tracking Progress With Credit Reports

Regularly reviewing your credit reports helps you monitor how your debt repayment affects your credit health. Watching for on-time payment entries, lowering balances, and absence of errors confirms that your strategies are effective. You can access free reports annually from each major credit bureau, allowing you to keep track and make informed adjustments if needed.

Maintaining a Healthy Credit Utilization Ratio

A key indicator of credit health is your credit utilization ratio, the percentage of available credit you are using. Consistently keeping this ratio below 30% is recommended to avoid negative score impacts. As you pay down balances, this ratio improves gradually. Avoid closing credit cards after paying them off since this reduces your total available credit and may increase your utilization rate inadvertently.

Recognizing When to Adjust Your Debt Repayment Strategy

Debt repayment plans should be flexible. If you notice stalled progress, rising interest rates, or changing financial circumstances, revisiting your approach is essential. Adjusting payment amounts, exploring refinancing options, or seeking professional advice can help maintain momentum. Staying attentive to these signals ensures you continue reducing debt effectively without risking credit damage.